“What gets measured gets done” – it

seems like the source of this quote, often attributed to management

expert Peter Drucker, isn’t certain, but its meaning is clear and very

relevant for every SaaS founder. If you want to make sure that you make

best use of your scarce resources, you need to have a clear

understanding of your objectives and the KPIs that measure your progress

towards those objectives.

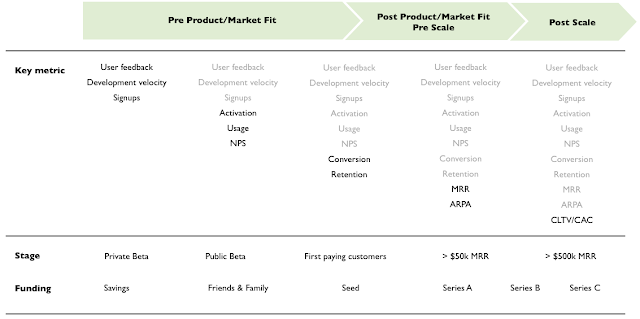

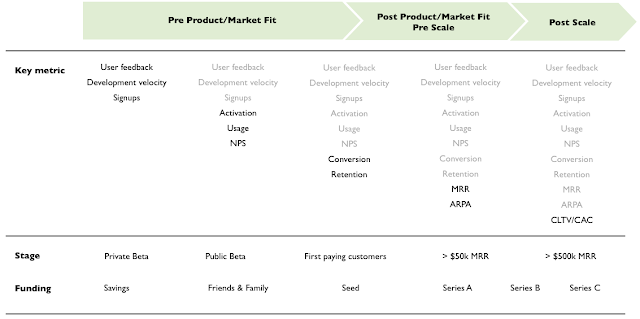

Depending on the stage that you’re in

you’ll want to focus on different metrics. I’ve tried to illustrate this

in the following diagram:

|

| (click image for larger version) |

As

you can see, I segmented the company lifecycle into three major phases:

pre product/market fit, post product/market fit but pre-scale, and

post-scale (being fully aware that there is no distinct definition of

“product/market fit” and “scale” and that the transition from one phase

to the next one is a gradual one). At the bottom I noted what these

phases usually mean in terms of the stage of your product and company

and which funding level it typically corresponds with. Note that the

x-axis is not a true-to-scale representation of time elapsed. For a

true-to-scale representation I would have to add much more space between

the Series A and the Series B and between the Series B and the Series

C.

The key message of the chart is that in the beginning you can

focus on a small set of metrics, but as time goes by and you’re making

progress you need to add additional KPIs to your cockpit.

Let’s have a closer look at each of the three phases.

Pre product/market fit

I’ve written about it before in my posts about

sales and

unscalable hacks:

In the very beginning, when you’re in the process of finishing the

first version of your product and trying to get the first customers, you

shouldn’t worry too much about metrics. Firstly there just aren’t many

metrics to keep an eye on yet. Secondly you should be

obsessively focused on getting to product/market fit (Marc Andreessen’s words), and that means you should spend your time talking to customers and developing the product.

That said, the following metrics are relevant in the pre product/market fit phase:

- User

feedback: Most of the user feedback that you collect in this phase is

qualitative rather than quantitative, but if you talk to a larger number

of potential users you might also be able to add some quantitative elements. For

example, you could ask users to rate your prototype and see if that

rating goes up over time.

- Development velocity: I

don’t know if (or how strictly) you should use a software development

methodology like Scrum, which allows you to nicely visualize your

development velocity, in the very early days, when you’re maybe just two

developers – I would be very interested in your thoughts on that

question. At any rate, however, I think it’s a good idea to break down

your project into a larger number of smaller pieces, features or “story

points” early on. This will help you in getting an understanding of your

development speed, which later on will become more and more important.

- Waiting

list signups: When you put up a landing page to collect email addresses

for your waiting list, track how many signups you’re getting. Driving

signups probably isn’t a key priority for you at this stage but it’s an

indication of interest in your product and hey, you’ll still have some

space on your Geckoboard which you can fill with a nice chart! :)

Once

you let potential customers try your product, the real fun begins. At

that point, you should track

signups and some indicators for

activation

and

usage, which, for obvious reasons, are precursors to your ultimate

goal, paying customers. What the right indicators for activation are

depends on the type of your product. It could be a profile completion

and the setup of a customized pipeline in case of a CRM application, the

installation of a tracking snippet for a Web analytics product or… you

get the idea. Similarly, usage metrics are highly specific to your

application, so think about what the right events and parameters are in

your particular case and make sure that you instrument your application

accordingly. If your solution is a little more enterprisey and you’re

working with a higher-touch sales model you may also want to track

qualified leads along with trial signups.

In order to succeed you

need happy customers who do free marketing for you, otherwise customer

acquisition will always be an uphill battle. Therefore you should also

consider regular

Net Promoter Score (NPS) surveys. If you’re looking for the best survey tool,

I have a tip for you.

Post product/market fit, pre scale

As

you’re slowly but surely getting to product/market fit and starting to

get the first paying customers (yay!), your

trial-to-paid conversion

rate becomes one of the most vital metrics. It’s hard to give you a

benchmark, since your conversion rate not only depends on the quality of

your product and the onboarding experience but also on many other

things such as leads quality, pricing and many other

factors. With that caveat in mind, the typical range that we’re seeing

is between 5% and 25%.

Equally important is your

retention,

usually tracked by measuring

churn (the inverse of retention), since

your CLTV (customer lifetime value) is a direct function of how much you

charge your customers and how long they stay on board. As a very rough

rule of thumb you should try to get your churn rate to 1.5-3% per

month.

Make sure to track churn not only on an account basis but

also on an MRR basis. Your MRR-based churn rate will hopefully be

significantly lower than your account-based churn rate, since smaller

customers tend to have a higher churn rate and because your loyal

customers will hopefully pay you more and more over time. Also, make

sure that you avoid

SaaS Metrics Worst Practice #8, mixing up monthly and yearly plans. Finally, if you want to get a good estimate of your customer lifetime, take a look at

retention on a cohort basis.

If

you don’t have a KPI dashboard yet that gives you an at-a-glance look

at your key metrics, now is the time to build one. Here’s

a template that I’ve created, along with some additional notes.

As

you’re moving on, arguably the most important metric becomes

MRR, and specifically

net

new MRR that you’re adding each month. Net new MRR is calculated using

this simple formula:

Also

keep an eye on your ARPA (average revenue per account). It’s an

important metric at all times for obvious reasons, but as you’re nearing

the next phase it’s becoming even more important.

Post scale

When

you’ve reached a certain level of success, say you’re at around $500k

MRR, the biggest challenge (besides growing a bigger organization and

mastering all kinds of growing pains of course) is to find ways to

profitably acquire customers at a much higher scale. By this time you’ve

picked all the low-hanging fruits, and you may have maxed out what you

can reasonably spend on AdWords to buy traffic and leads.

Therefore

you’ll have to focus on the relationship between your CLTV and your

CACs (customer acquisition costs), your

CLTV/CAC ratio, which measures

the ROI on your sales and marketing investments. Another way to look at

it is your

CACs payback time, which tells you how many months of

subscription revenue it takes to recoup customer acquisition costs. If I

had to choose I’d pick this one, since CLTV is always an estimate which

can be more or less accurate.

A few last points:

- Many

startups struggle to get all these numbers together because different

numbers are collected in different systems (e.g. Web analytics software,

billing systems, self-made databases,...), which often leads to

inconsistencies. I don’t have a simple and general advice for this

issue, I might address it in another post.

- If you’re

not sure which metrics to track, e.g. which events in your application,

err on the side of tracking too much data even if you have no immediate

use for it. You never know if it becomes useful in the future, and the

costs for tracking large amounts of data are no longer very high

nowadays.

- If you want to read more about SaaS metrics, I highly recommend David Skok’s blog and Joel York’s blog, as well as Jason M. Lemkin and Tomasz Tunguz.

That was it for the 8th DO for SaaS startups – questions, comments and suggestions are as always very welcome!

[Update 01/17/2015: There's a new company called

ChartMogul (

which we invested in) which makes it easy to get a real-time dashboard of your SaaS metrics.

Check it out!]